Wilson Loops

Why is it interesting?

Gauge fields like the photon field or gluon fields are usually described using gauge potentials. An alternative is to use Wilson lines. In contrast to gauge potentials, Wilson loops are completely gauge invariant. The set of all Wilson loops is sufficient to reconstruct the corresponding gauge potential.

The formulation of Yang-Mills theory which makes use of Wilson loops is called loop formulation.

Layman

A particular nice system to understand Wilson loops in a non-technical context are financial markets.

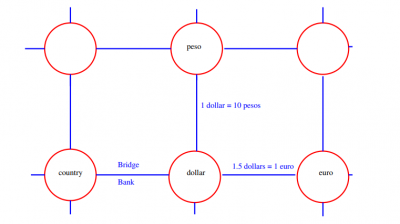

Say, we represent different countries by different points on a lattice. Each country has its own currency. However, the absolute values of the different currencies has no meaning of all on the global money market. Instead, all that counts are the relationships between the different currencies. The exchange rates between different currencies is encoded in something we call connection.

Now, how can we make money on the money market?

Well, let's say we are a banker in London. We have a budget of 100 pounds. Our goal is to trade our currency against other currencies in such a way that we have in the end more than 100 pounds. This means, we need to look for profitable loops through the global money lattice. We are interested in loops, because to actually determine if have earned money, we need to compare our final amount of money with the 100 pounds we started with. This is only possible if the final amount of money is also given in pounds.

Let's say the exchange rates are as follows:

- 1.5 dollars = 1 pound,

- 1 dollar = 10 pesos,

- 1 pound = 10 pesos.

How can we make money in this situation?

- We start by trading our 100 pound against 150 dollars.

- Then, we trade the 150 dollars against 1500 pesos.

- Finally we trade the 1500 pesos against 150 pounds.

Thus, by trading in a loop we have gained 50 pounds.

The loops we considered here are exactly analogous to the Wilson loops used in quantum field theories. The gauge freedom corresponds here to the freedom to rescale the local currencies. For examples, England could introduce a new currency called "new-pound" and determine that 1 new-pound is worth 10 pounds. This wouldn't change the situation at the global money market at all, because all banks would simply adjust their exchange rates: